Introduction

Your credit score plays a critical role in your financial life in the United States. It affects whether you get approved for credit cards, car loans, mortgages, apartments, and even some jobs.

If you’re wondering how to improve credit score in USA, you’re not alone. Millions of Americans search for ways to increase their FICO or VantageScore every year.

In this guide, you’ll discover practical, proven strategies to help you improve your credit score step by step in 2025.

What Is a Credit Score and Why It Matters in the USA?

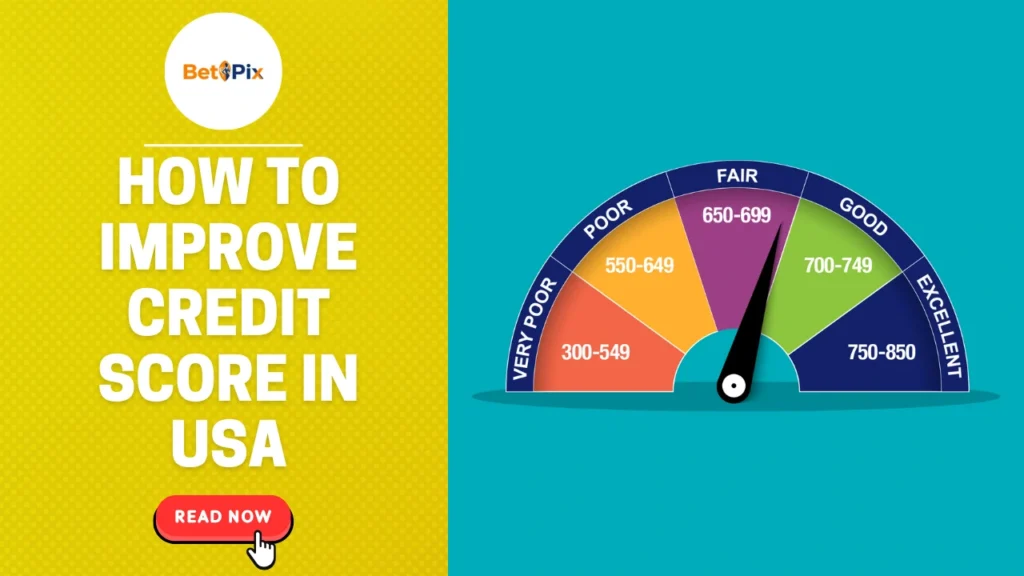

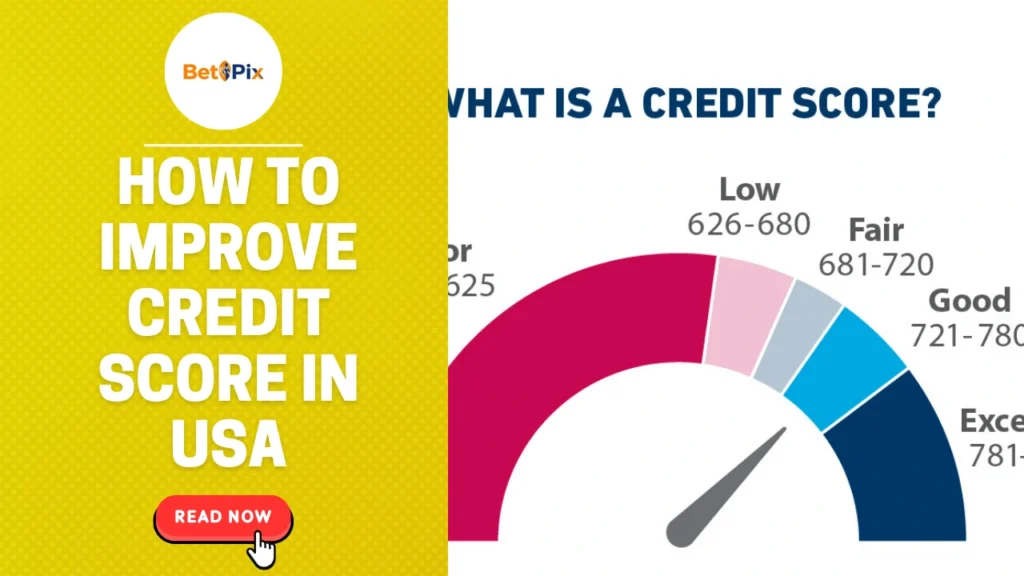

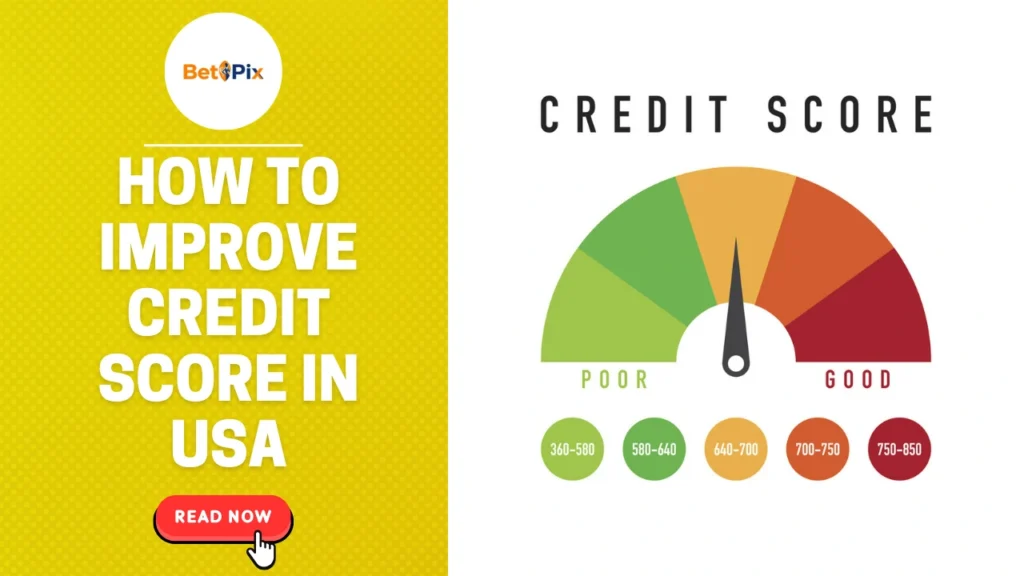

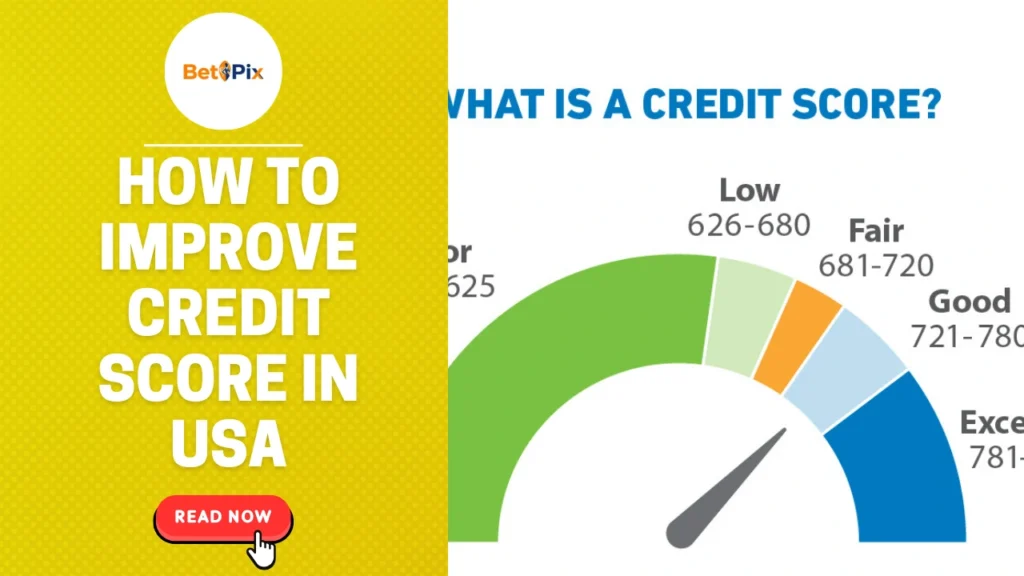

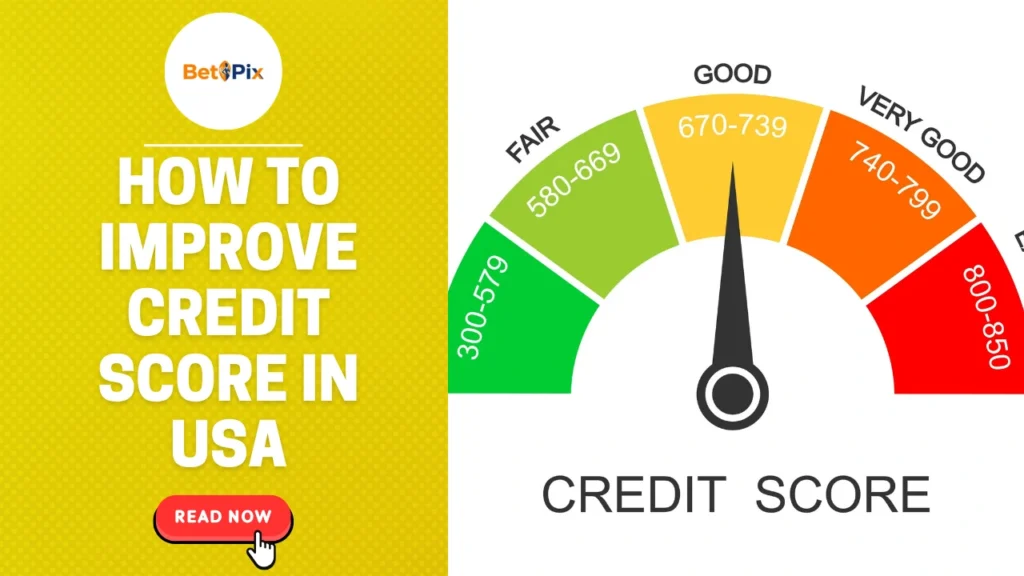

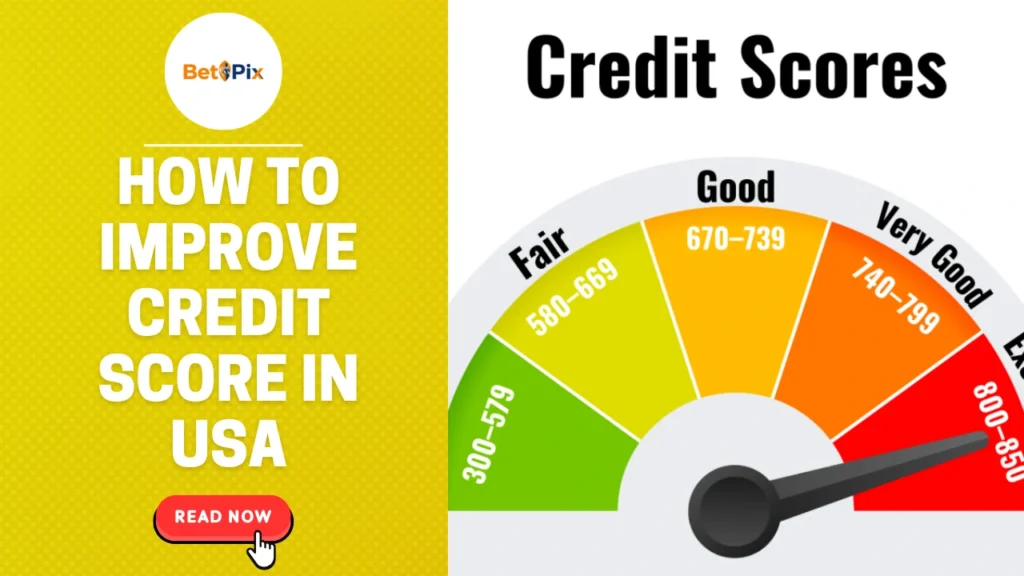

A credit score is a number ranging from 300 to 850 that represents your creditworthiness.

In the USA, your score is mainly calculated by:

- FICO

- VantageScore

Credit Score Ranges:

| Score Range | Rating | Meaning |

|---|---|---|

| 300–579 | Poor | Very hard to get approved |

| 580–669 | Fair | Limited and expensive credit |

| 670–739 | Good | Approved for most loans |

| 740–799 | Very Good | Lower interest rates |

| 800–850 | Excellent | Best loan offers |

A good credit score allows you to:

✅ Get lower interest rates

✅ Qualify for higher loan amounts

✅ Rent apartments more easily

✅ Save thousands of dollars on interest

How Credit Scores Are Calculated in the USA

To understand how to improve credit score in USA, you must know what affects it:

Key Credit Score Factors:

| Factor | Weight (%) |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit History Length | 15% |

| Credit Mix | 10% |

| New Credit Inquiries | 10% |

Improvement starts by targeting these factors strategically.

Step-by-Step Guide: How to Improve Credit Score in USA

Here are proven steps you can follow immediately:

✅ Step 1: Pay All Bills On Time

Late payments drastically hurt your score.

What to do:

- Set up automatic payments

- Use reminders

- Pay at least the minimum due

Even one late payment can stay on your report for 7 years.

✅ Step 2: Lower Your Credit Utilization Ratio

This is the percentage of credit you use compared to your total limit.

Ideal ratio:

Under 30%, best under 10%.

Example:

If your limit is $10,000 → Try to keep balance under $1,000.

✅ Step 3: Review Your Credit Report for Errors

In the USA, you’re entitled to 3 free credit reports per year from:

- Experian

- Equifax

- TransUnion

Look for:

- Wrong balances

- Unknown accounts

- Late payments you didn’t make

Dispute errors immediately.

✅ Step 4: Avoid Too Many Hard Inquiries

Too many credit applications lower your score.

Tip:

Only apply when necessary, and space them out.

✅ Step 5: Keep Old Accounts Open

Closing old cards shortens your credit history.

Even if you don’t use them often, keep them active with small purchases.

✅ Step 6: Diversify Your Credit Mix

A healthy mix includes:

- Credit cards

- Auto loans

- Student loans

- Mortgages

This shows lenders you can manage different credit types.

✅ Step 7: Become an Authorized User

If a family member has good credit, ask to be added as an authorized user.

It can significantly boost your score.

✅ Step 8: Consider a Secured Credit Card

Great for rebuilding bad credit.

You provide a deposit, and the bank gives you a card with that limit.

✅ Step 9: Request a Credit Limit Increase

A higher limit = lower utilization (if spending stays the same).

This instantly improves your score.

✅ Step 10: Use Credit Builder Loans

These are designed specifically to help improve credit for beginners or people with low scores.

How Long Does It Take to Improve Credit Score in USA?

Time depends on your situation:

| Change | Time to Impact |

|---|---|

| Lower credit utilization | 1–2 months |

| Fix errors | 1–3 months |

| Late payment recovery | 6–12 months |

| Major score rebuild | 12–24 months |

Consistency is key.

Common Mistakes When Trying to Improve Credit Score

Many people harm their credit without knowing it:

❌ Paying only minimum forever

❌ Maxing out cards

❌ Closing old accounts

❌ Applying for too many cards

❌ Ignoring debt

Avoid these at all costs.

Advanced Tips to Boost Credit Score Faster

For faster results:

✔ Pay twice per month instead of once

✔ Use rent reporting services

✔ Set balance alerts

✔ Pay before statement closing date

✔ Avoid unplanned credit checks

Benefits of Having a High Credit Score in the USA

A high score helps you:

✅ Qualify for better mortgage rates

✅ Get approved for premium credit cards

✅ Lower insurance rates

✅ Get better financing on cars

✅ Save thousands over your lifetime

Best Tools to Track and Improve Credit Score

Popular in the US:

- Credit Karma

- Experian App

- MyFICO

- NerdWallet

Use them to monitor changes monthly.

Conclusion – Start Improving Your Credit Score Today

Now you fully understand how to improve credit score in USA.

Improving your credit score isn’t about shortcuts. It’s about:

- Consistency

- Smart habits

- Financial discipline

If you start today, you can see positive changes within 30–90 days.

👉 Start by checking your credit report, lowering utilization, and paying on time. Your future self will thank you.